72 Candlestick Patterns Quick Reference Cards Pdf

H c o o l h c l bullish (green) candle bearish (red) candle upper shadow real body lower shadow. Candlestick patterns are an important part of any technical trader's toolkit. Originally emerging in the early 18th century, candlestick were used primarily by Japanese Rice Traders. The use of candlesticks was later perfected by Soku Honma and ultimately brought to America Cby aStenve Ndisoln ein 1s991t.ick Pattern Reference Guide Bullish Trend.

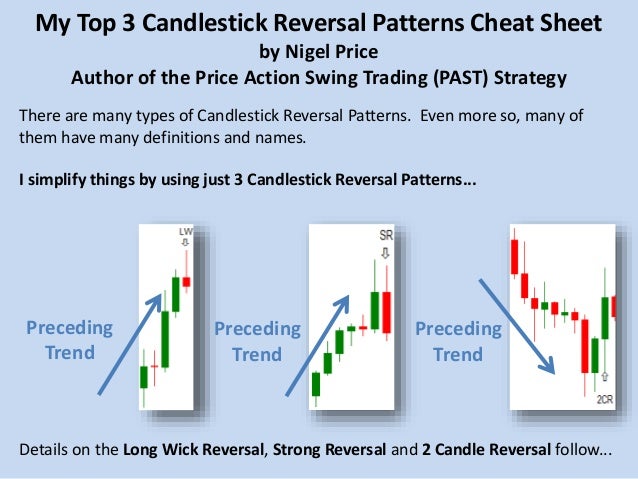

Make smart trading decisions using candlestick charting. This cheat sheet shows you how to read the data that makes up a candlestick chart, figure out how to analyze a candlestick chart, and identify some common candlestick patterns.

Constructing a Candlestick Chart

Four pieces of data, gathered through the course of a security’s trading day, are used to create a candlestick chart: opening price, closing price, high, and low. The candle in a chart is white when the close for a day is higher than the open, and black when the close is lower than the open. The wicks, lines sticking out of either end of the candlestick, represent the range between the day’s high and low prices. The wick on top shows the day’s high, the wick on the bottom shows the day’s low.

Additional information is sometimes displayed with candlestick charts. Don’t be afraid to use it! The following types of information are commonly included on candlestick charts and can be very useful in your analysis:

Volume: The total number of shares or contracts trading during a time period.

Open interest: The total number of open contracts on a futures product.

Moving averages: Lines that represent the average closing price for a time period and a few periods in the past.

Technical indicators: Statistics that can be displayed in a variety of ways on a chart.

Fundamental information: Data that includes dividend dates, days of share splits, or even insider buying and selling!

Candlestick Chart Analysis and Trading Tips

Babylon for mac crack. If you’re examining or trading a candlestick pattern, keep these guidelines in mind before you decide what to do with your money, so you can make an informed decision:

Determine whether the market is trending up, trending down, or not trending at all.

If you put on a trade, be prepared to identify the point at which you take a loss, especially when you’re trading against the trend.

Try not to anticipate that a pattern is going to be created by trading before the formation is complete.

Use technical indicators to complement patterns. Indicators help to confirm your opinion of the market trend.

When putting real money into trading, don’t trade what you can’t afford to lose!

Common Candlestick Patterns

You can become more familiar with some common and dependable candlestick patterns by checking out the following figures. (Remember, they don’t represent every possible candlestick pattern.)

Bullish two-day trend reversal patterns

These charts are a few of the most common and reliable bullish two-day trend reversal patterns in an uptrend.

Bullish two-day trend continuation patterns

These patterns are common and reliable examples of bullish two-day trend continuation patterns in an uptrend. Dungeon siege 2 windows 10.

Bearish two-day trend reversal patterns

These figures shows some of the most common and reliable types of bearish two-day trend reversal patterns in an uptrend.

Bearish two-day trend continuation patterns

These reliable two-day trend continuation patterns may show up frequently as you look through your candlestick charts.

Bullish three-day trend reversal patterns

Here are a couple common bullish three-day trend reversal patterns.

Bullish three-day trend continuation patterns

These two patterns are common examples of bullish three-day trend continuation patterns.

Bearish three-day trend reversal patterns

These are a couple of the most common bearish three-day trend reversal patterns.

Bearish three-day trend continuation patterns

Here are two common examples of bearish three-day trend reversal patterns.

Candlestick Quick Reference Guide.1.HC OOLHCLBULLISH(GREEN)CANDLEBEARISH(RED)CANDLEUPPER SHADOWREAL BODYLOWER SHADOW.-.#=' 9'#$ '$'?' #'='#= ' '#$## 1'+= 1'+='#BULLISH(GREEN)CANDLEBEARISH(RED)CANDLELARGEREALBODYSMALLREALBODYWIDERANGENARROWRANGEUPPERSHADOW(SELLING)LOWERSHADOW(BUYING).34.

6!1,4!1,3%#=%#$#'!@'#'/+'#'9/+###//+###'GRAVESTONEDOJIDRAGONFLYDOJI DOJI2#'$'#/+A#22B'#'3'#0$'#'%#=%#9/+'$//+'#$'.' +'$'+.$$. 4!1,3 5#11 #'4/944) 61.?' 6'###'#'#'11'11$#'.' 11.(. 4!1,3 5#, 5 #'4/944) 1.?'

6####$'#'#'#'#$, 5', 5$#'#', 5'11$#'#'.' , 5.(. 6!1,3 5, #'4/944) 1.?' /'#'#'#'#,'#,$#'#'.' ,B'.#.(. 6!1,3 5!, #'4/944) 61.?'

/##$'##'#'##$!,'#!,$#'B'!,'#,$#'.' !,.!. 6!1,3 C4/'.944)#'/'#'#'#'=#'##'A'##B#'#'.' .!. 4!1,3 C944)'.4/#C'6'###'#=#'#'A'#B#'#'.' .-.-.

6!1,3 C4/'.944)'$#C'/#'=#'#'#'#'#B')'#'##$'#'B'.' . 4!1,3 C944)'.4/'$C'6##'#=#'#'B')'#$'B'.'

.(4. 6!1,4!1,3 C#.'

C'OR2#'$'#,@.#$##'#)'#'$##'#,@.' $#'.'

$'.(4. 6!1,4!1,3 C#./+$C'OR2#'$'#,@.#$##'#+)'#'#,@.'

$#'.' $'.$. 6!1,3 C4/' 5.' =# D944)'$#=./'#' '$'#'#'#2$ #$='$'#'.' .!.$. 4!1,3 C944)' 5#.' =# D4/'$=.6'###' '#'#$'#'#'2$$='$'#.'

.5. 4!1,3$.,!9, '#6##'#'$'#'?B#$$##.' 3'?' $.5.

6!1,3$1#. '#/#'$'##'#?B$#$##.' #3'?'

#$. 6!1,.#3 6#944) -'4/E'B'6##' #'#'$'##'#'#.#'$'B'. 4!1,.#3 /4/ -'944)'B'/#'#'##$'##'#'.#'$'B'. 6!1,#3 944) -'.=4/$' -'944)'C6'#'#'3#$.' $'###'.'

.+. 4!1,#3 4/ -'.=944)$' -'4/'C/'#'3#$.' #'$'#'.' .